SurePlan – we’re with you every step of your financial journey

Our Vision

To better the lives of New Zealanders by providing the right advice, knowledge, financial structure and ongoing support. We believe this is the winning formula for long-lasting financial success. At SurePlan, we know that planning is the foundation for success in any endeavour.

Good financial planning allows you to feel secure that the right strategies are in place to take control of your future. We’ll help you avoid the costly mistakes that hold back most people’s financial progress, like paying too much interest or tax, or having poor structures that fail to maximise cash flow.

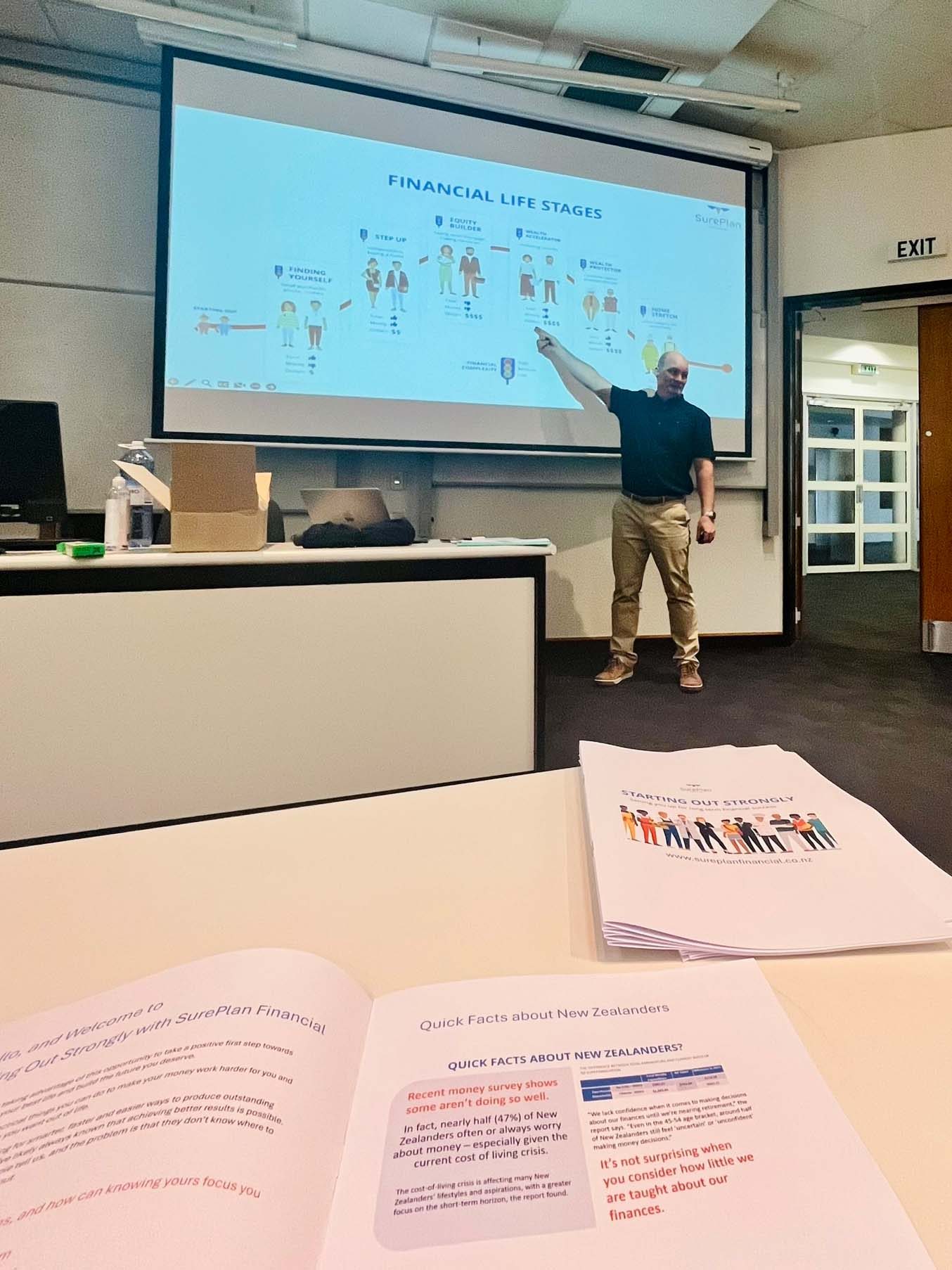

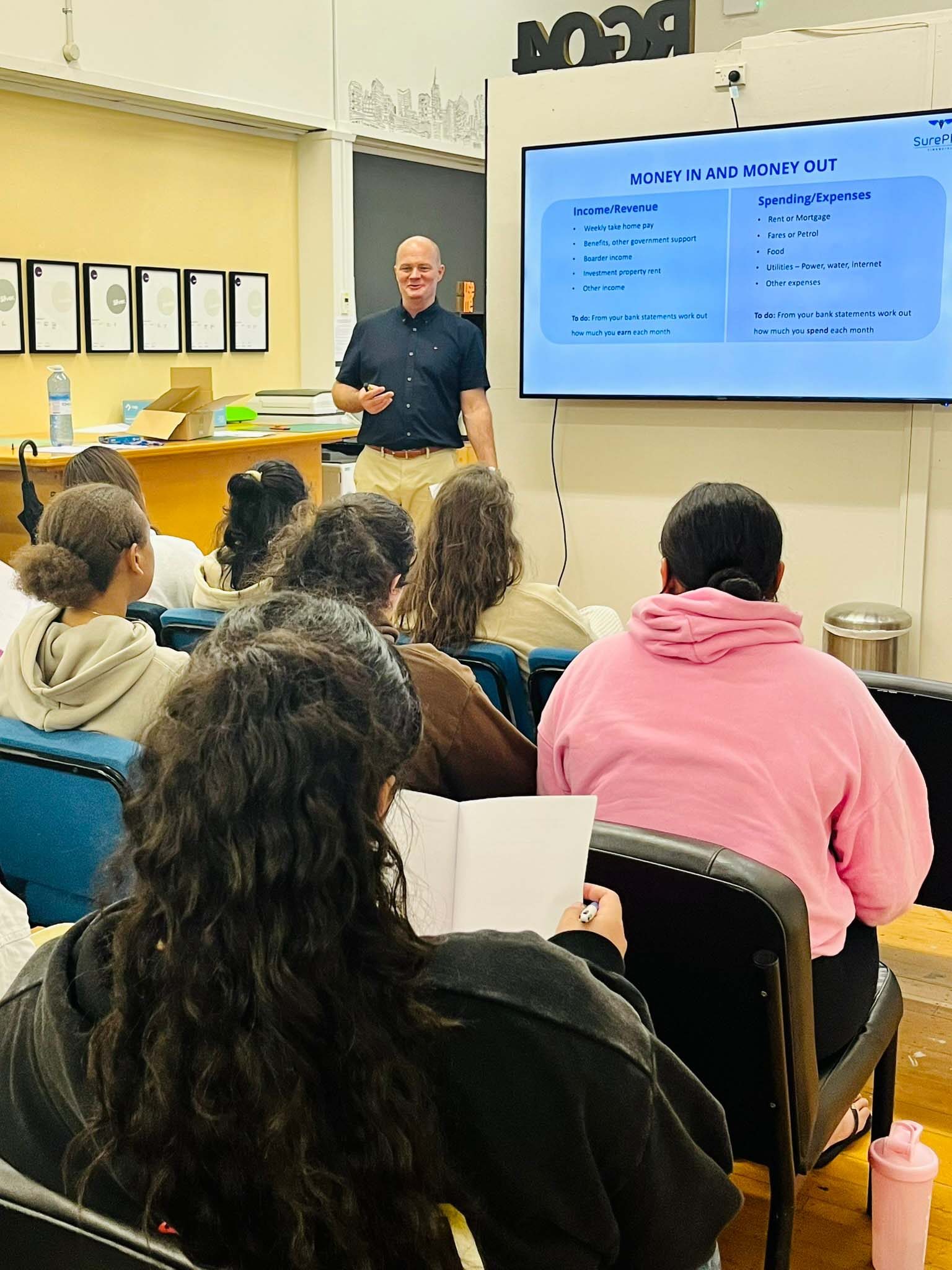

Giving back to New Zealanders

As a proud New Zealand business, we get excited about the opportunity to contribute to the communities we serve.

‘Once again, we what to thank you for your workshops, it was such valuable information, and it was amazing to see students so engaged with the content and having some great conversations which undoubtedly will be starting them in the right direction with their finances.

If you feel your students, members, or staff might benefit from exposure to strategies, knowledge and tools that help them get ahead financially, please reach out to John@sureplanfinancial.co.nz for a chat about our free community programmes.

Free no-obligation consultation

It costs nothing to check us out. We guarantee we will get you thinking differently and considering new ideas. Over 75% of couples who take advantage of our free no-obligation consultation choose to continue working with us.

About the consultation

This initial informal one-hour meeting is all about getting to know each other to make sure SurePlan is a good fit for you. If preferred, we can meet you at your home one weekday evening (we find that’s easiest if you work normal hours).

We’ll look at where you’re at right now, financially, and where you’re aiming to be. We will briefly run through our scope of service, process and costs with you, outline the information we require and answer any questions you might have. If you are keen to proceed, we’ll take it from there.

If you’re not quite ready to meet with us, why not take a couple of minutes to phone us with your questions? We are always happy to have a chat.