The financial services sector has earned itself a bad reputation over the last 10-15 years. Not only did the collapse of local investment companies like South Canterbury Finance, Hanover Finance and Bridgecorp Holdings cost some investors their life savings, but people’s trust was also shaken by high-profile legal cases such as those against ASB investment adviser Stephen Versalko and Ponzi scheme financier David Ross.

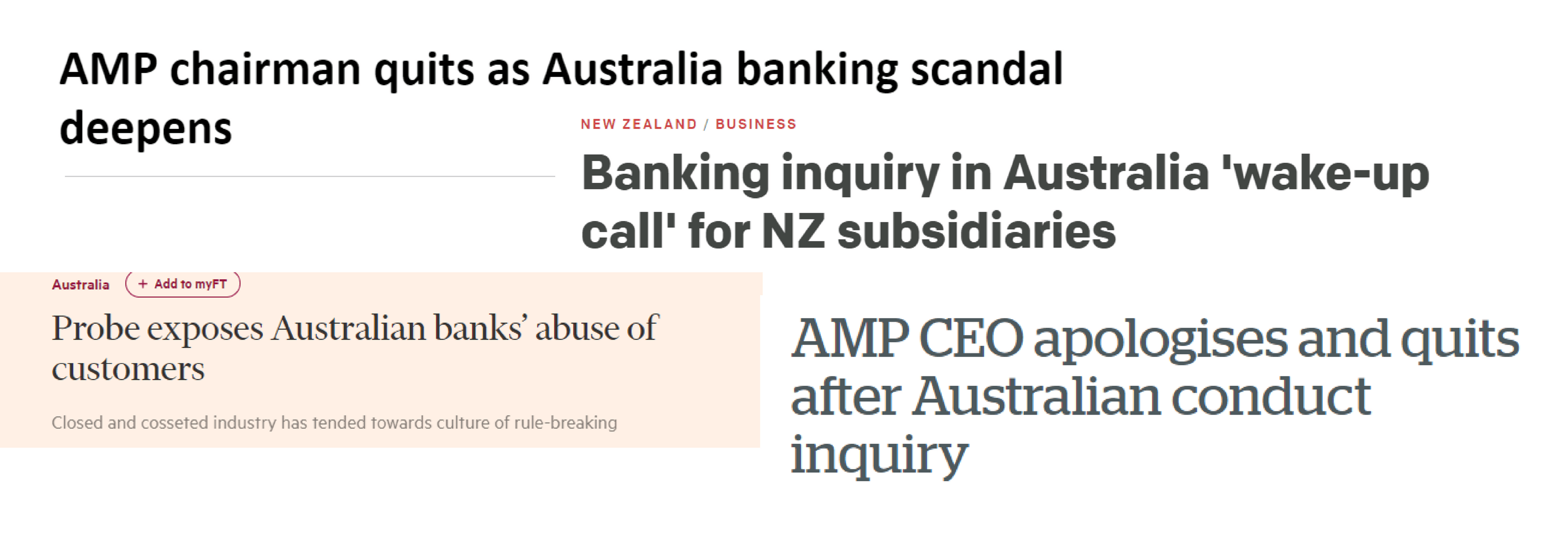

Across the ditch, I’ve watched the Australian banking sector lurch from one scandal to another, which prompted this year’s Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry. Over the course of the last several weeks, bosses from institutions such as the Commonwealth Bank of Australia, Westpac, ANZ and NAB have been grilled about dishonest practices that have collectively cost their customers millions of dollars.

The most recent phase of this enquiry has focused on the financial planning and wealth management industry, resulting in the resignation of AMP Limited CEO Craig Meller after it was revealed that his company not only charged clients for financial advice they had not received, but also tried to conceal it from the regulatory body.